Cowboy

TRUSTED VENDOR

- Joined

- Apr 18, 2024

- Messages

- 90

Top Bitcoin Layer 2 coins have risen 5% to 20% since halving, leaving BTC behind, according to data source CoinGecko.

Tokens associated with Bitcoin Layer 2 solutions have outperformed bitcoin (BTC) since the Bitcoin blockchain's highly-anticipated mining reward halving took effect early Saturday.

STX, the native token of leading Bitcoin Layer 2 network Stacks, has risen nearly 20% to $2.87 since quadrennial halving reduced the per block coin emission to 3.125 BTC from 6.25 BTC, according to data source CoinGecko. Bitcoin, meanwhile, has gained just over 4.7% to $66,300. STX is one of the best-performing top 25 cryptocurrencies of the past 24 hours, per Velo Data.

Other Layer 2 coins, like Elastos’ ELA token and SatoshiVM’s SAVM, have risen 11% and 5%, respectively, since halving.

ADVERTISEMENT

Bitcoin Layer 2 solutions are projects that address scalability and transaction speed limitations on the Bitcoin blockchain. They are built on top of the Bitcoin blockchain and bring scalability by processing transactions off the main chain.

While Ethereum Layer 2 solutions mainly focus on scaling the Ethereum smart contract blockchain, Bitcoin Layer 2 projects aim to scale and introduce programmability features to the main blockchain, which doesn't operate an Ethereum-like virtual machine.

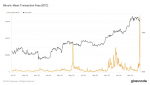

The market-beating move of Bitcoin Layer 2 coins comes amid the post-halving surge in transaction fees on the Bitcoin blockchain. Data tracked by Glassnode show the mean transaction fee soared to nearly 0.0020 BTC after halving, reaching the highest since early 2018.

The spike in fees could be explained by the launch of a new protocol called Runes that allows users to “etch” and mint tokens on the Bitcoin blockchain. Runes' debut saw speculators rush to mint tokens and trade meme coins, catalyzing increased transaction activity and higher transaction costs.

According to data source Ord.io, the total number of Runes inscriptions on the Bitcoin blockchain was 3,700 at press time.

- Top Bitcoin Layer 2 coins have risen 5% to 20% since halving, leaving BTC behind.

- The BTC-beating rise comes amid Runes-led spike in transaction fees on the Bitcoin blockchain.

-

Tokens associated with Bitcoin Layer 2 solutions have outperformed bitcoin (BTC) since the Bitcoin blockchain's highly-anticipated mining reward halving took effect early Saturday.

STX, the native token of leading Bitcoin Layer 2 network Stacks, has risen nearly 20% to $2.87 since quadrennial halving reduced the per block coin emission to 3.125 BTC from 6.25 BTC, according to data source CoinGecko. Bitcoin, meanwhile, has gained just over 4.7% to $66,300. STX is one of the best-performing top 25 cryptocurrencies of the past 24 hours, per Velo Data.

Other Layer 2 coins, like Elastos’ ELA token and SatoshiVM’s SAVM, have risen 11% and 5%, respectively, since halving.

ADVERTISEMENT

Bitcoin Layer 2 solutions are projects that address scalability and transaction speed limitations on the Bitcoin blockchain. They are built on top of the Bitcoin blockchain and bring scalability by processing transactions off the main chain.

While Ethereum Layer 2 solutions mainly focus on scaling the Ethereum smart contract blockchain, Bitcoin Layer 2 projects aim to scale and introduce programmability features to the main blockchain, which doesn't operate an Ethereum-like virtual machine.

The market-beating move of Bitcoin Layer 2 coins comes amid the post-halving surge in transaction fees on the Bitcoin blockchain. Data tracked by Glassnode show the mean transaction fee soared to nearly 0.0020 BTC after halving, reaching the highest since early 2018.

The spike in fees could be explained by the launch of a new protocol called Runes that allows users to “etch” and mint tokens on the Bitcoin blockchain. Runes' debut saw speculators rush to mint tokens and trade meme coins, catalyzing increased transaction activity and higher transaction costs.

According to data source Ord.io, the total number of Runes inscriptions on the Bitcoin blockchain was 3,700 at press time.