Bitcoin Price Predictions: 2024 End & 2025 Outlook

The world of Bitcoin is always changing, full of chances and challenges. Looking at bitcoin price predictions for 2024 and 2025 is crucial. It helps us understand the complex factors that affect its value.

Bitcoin's price changes a lot, catching everyone's attention. This is because of many things like market feelings, new tech, and world economy trends. Knowing these helps us see what the future holds for Bitcoin.

Key Takeaways

- Bitcoin's price predictions are influenced by various market factors.

- The end of 2024 could be a critical juncture for cryptocurrency valuation.

- Technological advancements play a significant role in shaping prices.

- Understanding global economic conditions is essential for accurate forecasts.

- Investor behavior and market sentiment significantly affect price fluctuations.

The world of Bitcoin price changes is always shifting. Many things affect these changes, like what investors think, market guesses, and big economic signs. Each part of this mix adds to Bitcoin's price ups and downs.

What investors feel really matters. When they're hopeful, they buy more, making prices go up. But if they're worried, they sell fast, causing prices to drop. This shows how feelings and the market are closely linked.

Speculation also adds to the mix. Traders use social media and news to make moves. For instance, a famous person's tweet can quickly change prices. Knowing how people react is key to guessing Bitcoin's future prices.

| Factor | Description | Impact on Price |

|---|---|---|

| Investor Sentiment | The overall mood of investors regarding Bitcoin. | Can drive prices up or down rapidly. |

| Market Speculation | Buying and selling based on expectations rather than intrinsic value. | Creates volatility and potential for quick gains or losses. |

| Macroeconomic Indicators | Factors such as inflation rates and government policies affecting the economy. | Influences overall market confidence. |

The Importance of Market Analysis in Bitcoin Predictions

Market analysis is key to predicting Bitcoin prices and understanding its ups and downs. It's a vital tool for investors to make smart choices. They use past data and current market trends to guide their decisions.

Looking at investor trends is a big part of market analysis. By tracking these trends, analysts can guess future price changes and demand shifts. This helps investors stay ahead of market swings, giving them a clearer picture of what's to come.

The world of cryptocurrency can be very unpredictable. But, with deep market analysis, investors can tackle this uncertainty with confidence. Spotting upcoming trends helps them make choices that fit their risk level.

At the end of the day, good market analysis is crucial for Bitcoin investment talks. The fast-changing world of digital currencies demands strong analytical tools. These tools are essential for success, showing the need for ongoing learning and adaptation in the crypto world.

Bitcoin Price Predictions for End of 2024 and the Forecasted Outlook for 2025

The world of cryptocurrency is always changing, with Bitcoin at the forefront. People watch trends closely to guess what will happen next. Looking at the end of 2024, there are many different ideas about how Bitcoin's price might grow. As we move into 2025, it's important to listen to what experts say and what's happening in the market.

Current Trends in Cryptocurrency

Recently, there have been big changes in the world of cryptocurrency. Things like new technology, news about rules, and how people feel about it all affect prices. Watching these trends can help us guess what prices might be.

- Adoption rates: More big investors coming in can make the market more stable.

- Technological upgrades: Better blockchain tech can make people more confident and active.

- Global economic factors: Big changes in the economy can change how people want to invest in crypto.

Experts have different ideas about what Bitcoin's price will be by the end of 2024. Some think it will go up a lot, while others are more careful because of possible ups and downs. Analysts look at different possibilities and what might happen to Bitcoin's price.

“The changing nature of Bitcoin means its price will likely show both positive and negative feelings in 2024,” an expert notes. “Investors should stay alert and ready for quick changes.”

| Price Prediction Scenario | Projected Bitcoin Price by End of 2024 | Factors Influencing Prediction |

|---|---|---|

| Optimistic | $100,000 | Widespread adoption and favorable regulations |

| Moderate | $60,000 | Steady market growth and minor regulatory challenges |

| Pessimistic | $30,000 | Major market corrections and economic downturns |

Key Factors Influencing Bitcoin Prices

Bitcoin's price is shaped by many things. Regulatory environments and adoption rates are key. These factors greatly affect how the market behaves and the value of Bitcoin.

Regulatory Environment

The rules around Bitcoin keep changing. This affects how people feel about investing and the demand in the market. For instance, good laws can make people trade more, which can raise prices. But, strict rules in big markets can cause prices to drop a lot.

Adoption Rates and Market Demand

Bitcoin is becoming more popular with businesses and people. This growth in acceptance boosts demand, which is crucial for the bitcoin forecast by the end of 2024. When more places start using Bitcoin or companies hold it as an asset, prices tend to go up. Knowing these factors can help investors make better choices.

| Factor | Impact on Prices |

|---|---|

| Regulatory Changes | Can lead to price surges or declines based on investor confidence |

| Adoption Rates | Higher adoption typically results in increased market demand and price increases |

The future of Bitcoin pricing will be shaped by new trends in tech and finance. As more people get into cryptocurrencies, it's key to know these trends. This is important for both investors and fans.

Technology is a big player in cryptocurrency trends. New blockchain tech makes Bitcoin safer and more efficient. This could lead to more people using Bitcoin, which could raise its value.

How society views Bitcoin also matters a lot. As more people and businesses use it, demand goes up. Seeing Bitcoin as a real investment can make prices go higher.

Big financial companies investing in Bitcoin is another big deal. Their support can make investors more confident. This can lead to even more money going into Bitcoin, affecting its price.

In short, tech, society, and big investors all play a part in Bitcoin's future. Watching cryptocurrency trends and market changes can help investors plan. It gives them a better idea of where Bitcoin might go.

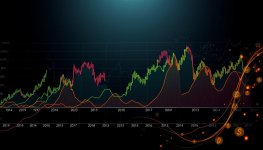

Previous Bitcoin Price Patterns and Their Relevance

To understand Bitcoin's price, we must look at its past prices. This helps us see trends and cycles. These patterns are key for investors to make smart choices.

By studying these patterns, we can guess how Bitcoin might act in the future. This helps in making accurate predictions about its price.

Historical Price Analysis

Looking at Bitcoin's past prices shows us important moments and big swings. We see big ups and downs in the market. This helps investors guess what might happen next.

Lessons Learned from Past Market Trends

Learning from past trends is crucial for good investment strategies. Big events, like market highs or new rules, teach us to be careful. By remembering these lessons, investors can handle Bitcoin's market better.

Investment Strategies for 2024 and Beyond

Creating good investment plans is key for dealing with the changing world of Bitcoin and digital assets. As we look ahead to 2024 and later, it's vital to understand the importance of diversifying in digital assets. This method helps lower risks and aims to increase potential gains, even with the ups and downs of crypto investments.

Diversification in Digital Assets

Diversifying means spreading out investments across different cryptocurrencies, tokens, and blockchain projects. This way, investors can lessen the impact of a bad investment on their whole portfolio. It's a smart move given the unpredictable nature of cryptocurrencies and the many factors that can affect their prices. Here are some benefits of diversifying in digital assets:

- Risk mitigation: A diversified portfolio can protect against big losses from one bad asset.

- Access to new opportunities: Investing in various digital assets lets investors tap into new trends and technologies.

- Stability: Spreading investments can make a portfolio more stable overall.

It's important to know the difference between long-term and short-term investment strategies. Each has its own pros and cons. Long-term holding means keeping an asset for a long time, believing in its value over time. This is for those who want steady growth, often buying more when prices drop.

On the other hand, short-term trading aims for quick profits from market changes. It can bring fast gains but also comes with higher risks due to market volatility. Investors might choose a mix of both strategies, depending on their goals and the market.

| Investment Approach | Advantages | Disadvantages |

|---|---|---|

| Long-Term Holding | Potential for steady growth | May miss short-term opportunities |

| Short-Term Trading | Quick profits from fluctuations | Higher risk due to market volatility |

| Diversification | Reduces risk and stabilizes portfolio | Potentially lower returns from high-growth assets |

Predictions for Bitcoin Price: What Analysts Say

The world of Bitcoin is always changing, making predictions both exciting and important for investors. Many experts and financial groups share their views on Bitcoin's future. They highlight the need to look at market analysis for 2025.

Experts have different ideas about Bitcoin's future. Some think it will go up because of more businesses using it and new tech. Others worry about possible drops in value that could affect the outlook for 2025.

- Optimistic View: Some say Bitcoin could hit new highs, with prices possibly reaching $100,000 to $300,000. This depends on how the market moves.

- Conservative Approach: Others think Bitcoin might stay around $50,000 to $80,000. They point to rules and market ups and downs as key factors.

- Bearish Predictions: Some warn of a price drop, saying Bitcoin could fall below $30,000. They mention outside economic issues as a risk.

| Analyst | Prediction Range | Main Factors Considered |

|---|---|---|

| Institution A | $100,000 - $300,000 | Adoption rates, technological advancements |

| Institution B | $50,000 - $80,000 | Regulatory pressures, market volatility |

| Institution C | Below $30,000 | Global economic conditions, market corrections |

Investing in Bitcoin comes with its own set of challenges and risks. It's important for investors to understand these factors. This knowledge helps navigate the complex world of cryptocurrency.

Market Volatility

Market volatility is a big concern for Bitcoin investors. Prices can swing wildly in short periods, leading to quick gains or losses. This unpredictability can be stressful and may scare off investors who prefer safer options.

Looking at past performance can offer some clues. But it doesn't promise stability in the future.

Global Economic Conditions

Global economic conditions greatly affect Bitcoin investing. Things like inflation, interest rates, and world tensions can sway investor feelings. For example, economic downturns might make investors shy away from riskier assets like Bitcoin.

Keeping an eye on these global factors helps investors make better choices. It can help lessen the impact of economic pressures.

Exploring Blockchain Predictions and Their Impact

Blockchain technology is growing fast and getting attention from more areas than just cryptocurrency. Experts say it could change finance, healthcare, and supply chains. This could open up new chances for digital assets like Bitcoin.

Looking closely at the crypto market shows blockchain's role in digital asset success. Things like making blockchain faster, safer, and clearer rules affect how people feel about investing.

Using smart blockchain predictions can help investors see what's coming. As more groups use blockchain, Bitcoin and other cryptos might get more valuable.

| Sector | Potential Impact of Blockchain | Examples |

|---|---|---|

| Finance | Increased transaction efficiency and reduced costs | Smart contracts, decentralized finance (DeFi) |

| Healthcare | Enhanced data security and interoperability | Patient records on blockchain, drug traceability |

| Supply Chain | Improved transparency and traceability | Tracking goods from origin to consumer |

Final Thoughts on Bitcoin's Future and Investment Viability

The world of Bitcoin is always changing, making its future both exciting and unsure. As it grows, knowing if it's a good investment is key. Recent studies show how different things affect Bitcoin's price, like market mood, new rules, and tech updates.

For those wanting to invest, keeping up with new trends is important. Things like how many people use Bitcoin and if it's seen as a real asset matter a lot. When these things happen together, Bitcoin's price might change a lot.

The table below shows possible price trends and investment plans for Bitcoin. It looks at important market signs:

| Market Indicator | Potential Price Impact | Notes |

|---|---|---|

| Regulatory Changes | Volatility | Stricter rules might cause prices to drop in the short term. |

| Adoption Rates | Growth | More people using Bitcoin makes prices more stable. |

| Global Events | Uncertainty | Big economic issues can change how people invest. |

| Technological Advances | Stability | Better blockchain tech makes Bitcoin more trusted and useful. |

Conclusion

Looking at Bitcoin price predictions, we see many factors at play. These include regulatory changes, adoption trends, and global economic conditions. Understanding these is key for investors and enthusiasts alike.

Investing in Bitcoin requires ongoing learning. Keeping up with market trends and using smart strategies like diversification is vital. The future is uncertain, but staying alert to new developments can help.

The world of cryptocurrency is full of both risks and opportunities. By staying informed and adaptable, investors can make better choices. As the market evolves, being aware and flexible will help you succeed in the Bitcoin world.

FAQ

What are the bitcoin price predictions for the end of 2024?

Experts have different views on bitcoin's price by the end of 2024. They look at market trends, rules, and how people use it. Some think prices will go up, while others warn of possible drops.

How do expert opinions shape the forecasted bitcoin price outlook for 2025?

Experts' views are key in predicting bitcoin's price for 2025. They look at tech progress, how investors feel, and rule changes. This helps them make better guesses based on past data and current market conditions.

What key factors influence bitcoin prices?

Several things affect bitcoin prices. These include rules, demand, investor mood, and big economic issues. Knowing these helps predict prices and make smart investment choices.

How important is market analysis when predicting bitcoin prices?

Market analysis is crucial for guessing bitcoin prices. It looks at both the basics and the technical side. By studying past data and trends, analysts can give more accurate forecasts. This helps investors deal with market ups and downs.

What trends are shaping the future of bitcoin pricing?

New trends are changing bitcoin's pricing future. These include more tech use, wider acceptance in finance, and big investors getting involved. These changes make predicting prices more complex.

What investment strategies should be considered for bitcoin in 2024 and beyond?

For bitcoin in 2024 and later, diversifying in digital assets is smart. It helps spread out risks. Also, knowing the pros and cons of holding long or short term is key. This helps build a balanced portfolio in the unpredictable crypto world.

What are the potential risks and challenges for bitcoin investing?

Risks in bitcoin investing include market swings and global economic issues. These can change how people feel about investing. Knowing these risks is important for safe investing.

How can blockchain predictions impact the future of bitcoin?

Blockchain predictions can greatly affect bitcoin's future. They show new chances for growth beyond just the currency. New blockchain tech could lead to more innovation and use, which could change bitcoin prices.